Factors Affecting Cost Of Travel Insurance

Traveling offers us a much-needed respite from the corporate race. Getting time off and visiting places you've always dreamed of seeing can be incredible for both your physical and mental well-being.

From flight cancellations and delays, lost or stolen luggage to poor weather conditions and health-related issues, there are many reasons why you might not be able to enjoy your trip. By getting travel insurance, you can protect yourself against the financial losses of these circumstances. Several factors influence the premiums of the travel insurance plan you select. Some of these include:

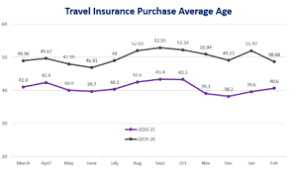

Age Of The Insured

The age of the person being insured is one of the most critical factors influencing travel insurance premiums. As older people are more likely to need assistance, their travel insurance premiums tend to be higher than young, healthy individuals. Travel insurance companies check the probability of people experiencing medical problems, and as older people are high-risk, their travel insurance premiums tend to be higher.

Coverage Required

Another factor significantly influencing travel insurance premiums is the amount of coverage you opt for. If you select a travel insurance plan that covers the bare minimum, your premiums will be much lower than a plan that covers more extensive costs. While traveling to high-risk areas, investing in an insurance plan that covers everything from delayed or canceled flights, lost luggage, health issues, and inconvenience due to natural disasters is sensible.

Medical Conditions

When purchasing an insurance plan for traveling, make sure to disclose any preexisting medical conditions you might have. The company will then ask to assess your health more thoroughly and offer you an insurance plan that better fits your needs. While this plan's premiums may be higher than regular, it will provide better support if you were to seek medical help overseas.

Frequency Of Travel

The frequency of travel is directly related to travel insurance premiums. If you're a frequent traveler, buying a multi-trip travel insurance plan may be better than buying it for a trip every time. The premiums of a multi-trip plan are, of course, higher than the single-trip one but will be saving you money in the long run.

Conclusion

Several factors influence a travel insurance premium, and knowing about them can help you make an informed decision about the plan you want to invest in. By considering all the factors, you can choose the best travel insurance to suit your needs.

Related Articles

- What consumer benefits does life insurance offer?

- Getting Homeowners Insurance With a Bad Roof

- The Advantages And Disadvantages Of Purchasing Permanent Life Insurance

- What to Look For When Selecting an Insurance Provider

- Challenges Facing the Insurance Industry Today

- What Does Your Car Insurance Policy Not Cover?

- The different types of health insurance plans you should know about

- Top 5 Homeowners Insurance Mistakes You Should Avoid Making

- The Insurance Industry’s Trends

- Why You Should Get Over 60s Life Insurance

Reading Rankings

- Reasons you may need to file a travel insurance claim

- What are the principles of good insurance?

- The Advantages And Disadvantages Of Purchasing Permanent Life Insurance

- The Top 5 Life Insurance Mistakes That People Make

- Top 5 Homeowners Insurance Mistakes You Should Avoid Making

- The Insurance Industry’s Trends

- Top Insurance Providers in the World

- Do I Require Insurance For My Home-based Business?

recommended

![]()

Which Is Better - Term Life Insurance Or Permanent Life Insurance

![]()

Getting Homeowners Insurance With a Bad Roof

![]()

How Covid-19 has affected the Insurance Industry

![]()

The Advantages And Disadvantages Of Purchasing Permanent Life Insurance

![]()

Top 5 life insurance mistakes people make

![]()

Get homeowners insurance for bad roofs

![]()

Reasons why your homeowners insurance may be cancelled

You might like

- Get homeowners insurance for bad roofs

- How Covid-19 has affected the Insurance Industry

- Challenges Facing the Insurance Industry Today

- Understanding Mortgage Insurance and Homeowners Insurance

- The Top 5 Life Insurance Mistakes That People Make

- Do I Qualify For Life Insurance If I Have A Pre-Existing Disease

- Which Is Better - Term Life Insurance Or Permanent Life Insurance

- Reasons why your homeowners insurance may be cancelled