Which Is Better - Term Life Insurance Or Permanent Life Insurance

The two standard life insurance policies that people purchase are term life insurance and permanent life insurance. You can choose a life insurance policy depending on your immediate needs, long-term financial stability, and several other factors. While term life insurance is better for many people, some find permanent life insurance more promising.

To decide which policy might be more suitable for you, knowing the differences between the two is essential. In this article, we will tell you which circumstances call for what policy. So let's get started!

Term Vs. Permanent Life Insurance

The names can be used to understand the difference between term and permanent life insurance. However, term insurance is relatively more popular than permanent life insurance. The premiums for a permanent life insurance policy may cost 5 to 15 times more than a term policy with similar death benefits. But that's not all. To know in detail about the two types, keep reading.

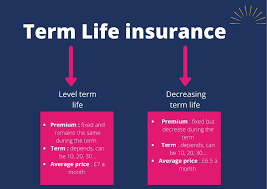

Term Life Insurance

As the name indicates, term life insurance is purchased for any amount of time. Whether it's five, ten or fifteen, or twenty years, a term life insurance policy expires after the given period. This policy is possibly the simplest type of life insurance policy.

Term life insurance policy is preferred by many because of lower and more affordable monthly premiums. Not only that, the death benefits paid to the beneficiary(s) are almost the same as a permanent life insurance policy. However, the downside of a term life insurance policy is that they do not have a cash value component. Not having a cash value component means you will not receive any benefits if you outlive the policy.

Nevertheless, you can add a return-of-premium rider to the policy, which will ensure you receive the total premiums paid over the given time. But adding this rider will significantly increase your term life insurance premiums.

Permanent Life Insurance

Permanent life insurance lasts for as long as your life does. After the death of the policyholder, the beneficiary(s) are paid the death benefit. The downside of a permanent life insurance policy is that the monthly premiums are much higher than a term policy.

A permanent life insurance policy will be a better choice if you may have significant outstanding dues such as estate taxes when you die. In such a case, the death benefit paid by the permanent life insurance policy can be helpful.

Conclusion

Both term and permanent life insurance policies have their pros and cons. Contact your financial advisor today and find out which one will be more suitable for you!

Related Articles

- The Essential Insurance Covers Everyone Should Have

- How Covid-19 has affected the Insurance Industry

- What To Look For In Your Health Insurance Policy

- What to Look For When Selecting an Insurance Provider

- The Advantages And Disadvantages Of Purchasing Permanent Life Insurance

- Reasons Why Your Homeowner's Insurance Might Get Cancelled

- Mistakes you may make when applying for homeowners insurance

- The Major Policies Offered Under Property Insurance Cover

- Top 5 life insurance mistakes people make

- Mistakes You Can Make When Claiming Your Homeowner's Insurance

Reading Rankings

- The essential functions of an insurance company

- Why your auto insurance claim may not be accepted

- The Insurance Industry’s Trends

- How to get lower health insurance premiums

- 2022’s Top Car Insurance Companies

- Mistakes you may make when applying for homeowners insurance

- Mistakes You Can Make When Claiming Your Homeowner's Insurance

- Everyone Should Have These Insurance Policies

recommended

![]()

The Major Policies Offered Under Property Insurance Cover

![]()

Lapses: An Overview

![]()

2022’s Top Car Insurance Companies

![]()

Everything you need to Know about Health Insurance Cover

![]()

What Is The Role Of A Home Insurance Broker?

![]()

Top Insurance Providers in the World

![]()

Reasons why your homeowners insurance may be cancelled

You might like

- Everyone Should Have These Insurance Policies

- The Top 5 Life Insurance Mistakes That People Make

- What to Look For When Selecting an Insurance Provider

- The Major Policies Offered Under Property Insurance Cover

- Get homeowners insurance for bad roofs

- Factors Affecting Cost Of Travel Insurance

- The Essential Insurance Covers Everyone Should Have

- Do I Qualify For Life Insurance If I Have A Pre-Existing Disease