Get homeowners insurance for bad roofs

When buying homeowners’ insurance, it’s important to understand the details behind it.

Most states require policies that cover wind, fire, and hail damage, but the type of roof you have will affect your coverage. Generally speaking, the age, slope and structure of the roof will affect the cost of your homeowners insurance. Read on for complete details on how to get homeowners insurance for a bad roof.

Understand the limitations

The homeowner’s insurance policy usually covers the cost of repairing a roof damaged by a storm, fire, or hail. But there are restrictions-depending on the insurance company and policy, the insurance company may only pay a certain amount.

Obtain a separate policy.

The roof is a major investment, and many homeowners insure their roofs separately under separate policies. Although many homeowners have separate policies for their roofs, not everyone does it. The age, material type and condition of the roof are all factors that affect the possibility of water leakage, and therefore also affect the maintenance cost. If your roof is out of date or in disrepair, the repair costs may exceed your deductible. In this case, you can develop a separate policy for your roof.

How to apply for home insurance when the roof is not good

If your roof is damaged or you suspect that your roof may be damaged, there are a few steps you can take to obtain homeowners insurance.

Get free inspection.

Insurance companies can ask a licensed contractor to inspect your roof, or they can directly accept a licensed contractor’s valuation. Your policy will specify what is covered and what is not covered.

Insurance companies may request roof and roof system information, including:

The age of the roof

Type of roofing material used

Repair or replacement cost

History of hail damage and repair

History of fire or lightning damage

The history of leaks

History of wind damage

The condition of the roof will affect its value, and that value will affect whether your insurance policy covers any repairs or replacements.

The insurance company may also require the roofing contractor to provide repair estimates and estimates. If the insurance company accepts the estimate, it will use the cost to determine your coverage and the amount you owe.

Get a valuation

After obtaining the results of the assessment, you can use this information to estimate the cost of repairing or replacing the roof.

Obtain roof replacement estimates.

After getting the quote, you can decide whether it is worth repairing the roof or buying a new roof altogether.

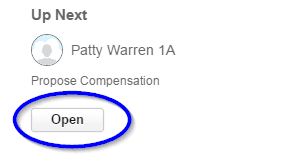

Propose compensation

After making a decision, please contact your insurance company and file a claim. In some cases, the insurance company may reject your claim.

Reasons for delay or denial of claim

It may be necessary to prove that the damage occurred under your roof or was not caused by you.

It may also require you to prove that you followed the insurance company's procedures for making a claim.Also, some companies may deny your claim because of insufficient roof coverage. If your home has a storm or hail roof, for example, you may have no coverage if the policy does not cover your roof’s material or composition.

Other companies may deny your claim if your roof's age is too old. If it's more than ten years old, some insurance companies may no longer cover it.

If your insurance company denies your claim, you can appeal the decision to state insurance commissioners, who have the authority to enforce insurance.

Get paid

If your roof is deemed structurally sound, you'll get a cheque from your insurance company and get paid.

Final Words

Homeowners insurance protects you from fire, theft, natural catastrophes, and many other risks. The insurance company will pay for repairs or replacement of damaged property up to your policy's limit. When looking for homeowners insurance, it's smart to shop around and compare quotes. That way, you can pick the policy with the best price.

Related Articles

- The Benefits and Risks of Life Insurance. Do you need one.

- Mistakes You Can Make When Claiming Your Homeowner's Insurance

- Challenges Facing the Insurance Industry Today

- Everything you need to Know about Health Insurance Cover

- The Advantages And Disadvantages Of Purchasing Permanent Life Insurance

- Reasons why your homeowners insurance may be cancelled

- The Top 5 Life Insurance Mistakes That People Make

- The role and importance of insurance

- The essential functions of an insurance company

- What Is Insurance Proof?

Reading Rankings

- Top 5 life insurance mistakes people make

- The Different Types of Insurance Companies

- Reasons you may need to file a travel insurance claim

- Do I Qualify For Life Insurance If I Have A Pre-Existing Disease

- What To Look For In Your Health Insurance Policy

- 2022’s Top Car Insurance Companies

- Get homeowners insurance for bad roofs

- What Is Umbrella Insurance? How Does It Work?

recommended

![]()

How To Make A Claim For Your Stolen Car

![]()

Challenges Facing the Insurance Industry Today

![]()

The Benefits and Risks of Life Insurance. Do you need one.

![]()

Get homeowners insurance for bad roofs

![]()

Factors Affecting Cost Of Travel Insurance

![]()

Why You Should Get Over 60s Life Insurance

![]()

The Essential Insurance Covers Everyone Should Have

You might like

- What To Look For In Your Health Insurance Policy

- What You Need To Know About Auto Insurance For Teenagers

- The role and importance of insurance

- The Major Policies Offered Under Property Insurance Cover

- How To Make A Claim For Your Stolen Car

- Mistakes you may make when applying for homeowners insurance

- Getting Homeowners Insurance With a Bad Roof

- The essential functions of an insurance company