What To Look For In Your Health Insurance Policy

Decided to get health insurance but confused while choosing the most suitable policy?

Making the right decision can get challenging, but learning just a few basic things can make it a lot easier (and save you from trouble in the long run).

So, follow me through this article as I talk about what you should check off your checklist before choosing the best health insurance policy!

The Right Deductible and Premium Combination

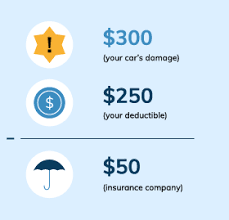

Simply put, a deductible is the fixed amount you initially pay before the company covers the rest of your expenses. On the other hand, premiums encompass the total cost you pay either in whole or in monthly installments.

Generally, higher deductibles mean lower premiums. You should look for the combination most suitable to you in your health insurance policy.

If you’re in good health, a higher deductible plan will work well for you. If you find yourself at the doctor’s place often and have high medical expenses, you’d be better off with a lower deductible plan.

Covering Medicines

If you’re someone who takes medications on a regular basis, you should check if your health insurance policy offers pharmaceutical coverage.

You should also check how this affects your premiums, and whether you need to purchase the generic or not.

Limits on Choosing Doctors and Hospitals

Insurance policies may not be accepted at your preferred doctor or hospital. And if you discover this after purchasing your premium, you may end up having to pay out of your pocket or resorting to unfamiliar doctors.

Therefore, you should always look for the provider network in your health insurance policy. This means you should consider whether your plan limits the doctors and hospitals you can choose from. If yes, you can always go through covered lists to see the policy that works with your preferred choices.

Copay and Coinsurance

Health insurance policies require you to pay copay and coinsurance independently on top of premiums.

Copay is the cost you pay at each doctor’s visit, while coinsurance is the amount you pay after the insurance company plays its part.

It’s always a good idea to look for these two aspects in your health insurance policy and figure out the ones that work for you best.

Choose Your Health Insurance Policy Wisely

With diverse options offered in the market, you can easily get lost while choosing the right plan.

But by knowing what to look for in your health insurance policy coupled with the right amount of research and thought, you can land the best health insurance plan for you in no time at all!

Related Articles

- Do I Qualify For Life Insurance If I Have A Pre-Existing Disease

- Get homeowners insurance for bad roofs

- Getting Homeowners Insurance With a Bad Roof

- Do I Require Insurance For My Home-based Business?

- What Is Umbrella Insurance? How Does It Work?

- Lapses: An Overview

- Why Your Car Insurance Claim Might Not Be Accepted

- Which Is Better - Term Life Insurance Or Permanent Life Insurance

- The Advantages And Disadvantages Of Purchasing Permanent Life Insurance

- Everyone Should Have These Insurance Policies

Reading Rankings

- Top 5 life insurance mistakes people make

- The role and importance of insurance

- Why Do You Need Travel Insurance?

- The insurance industry. Growing and Declining Sectors

- Lapses: An Overview

- Insurance role in addressing climate change and sustainable development

- The Essential Insurance Covers Everyone Should Have

- The different types of health insurance plans you should know about

recommended

![]()

Top 5 life insurance mistakes people make

![]()

The Advantages And Disadvantages Of Purchasing Permanent Life Insurance

![]()

Get homeowners insurance for bad roofs

![]()

5 Result-yielding Ways To Save Money On Your Homeowners Insurance

![]()

Mistakes You Can Make When Claiming Your Homeowner's Insurance

![]()

Why your auto insurance claim may not be accepted

![]()

Factors affecting travel insurance costs

You might like

- Reasons Why You Might Need To File A Travel Insurance Claim

- What To Look For In Your Health Insurance Policy

- Reasons why your homeowners insurance may be cancelled

- 5 Result-yielding Ways To Save Money On Your Homeowners Insurance

- The role and importance of insurance

- Top 5 life insurance mistakes people make

- What to Look For When Selecting an Insurance Provider

- What are the principles of good insurance?